The Path to Better Invoice Processing

2023 State of Digitization in B2B Finance

July 17th, 2023

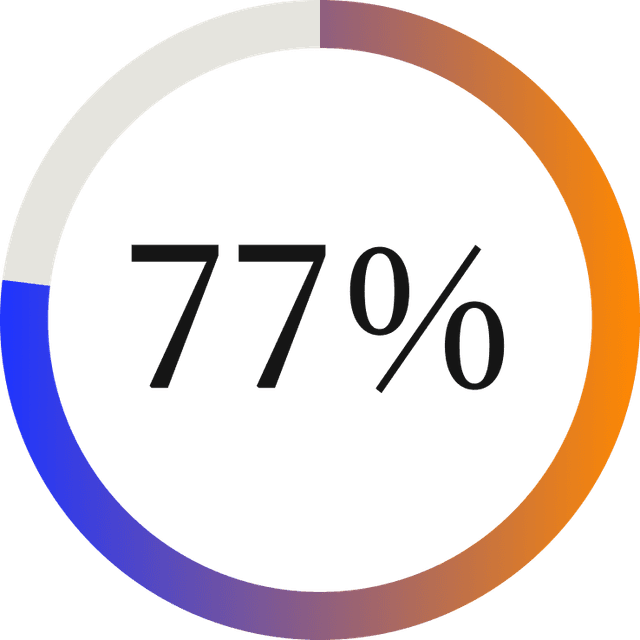

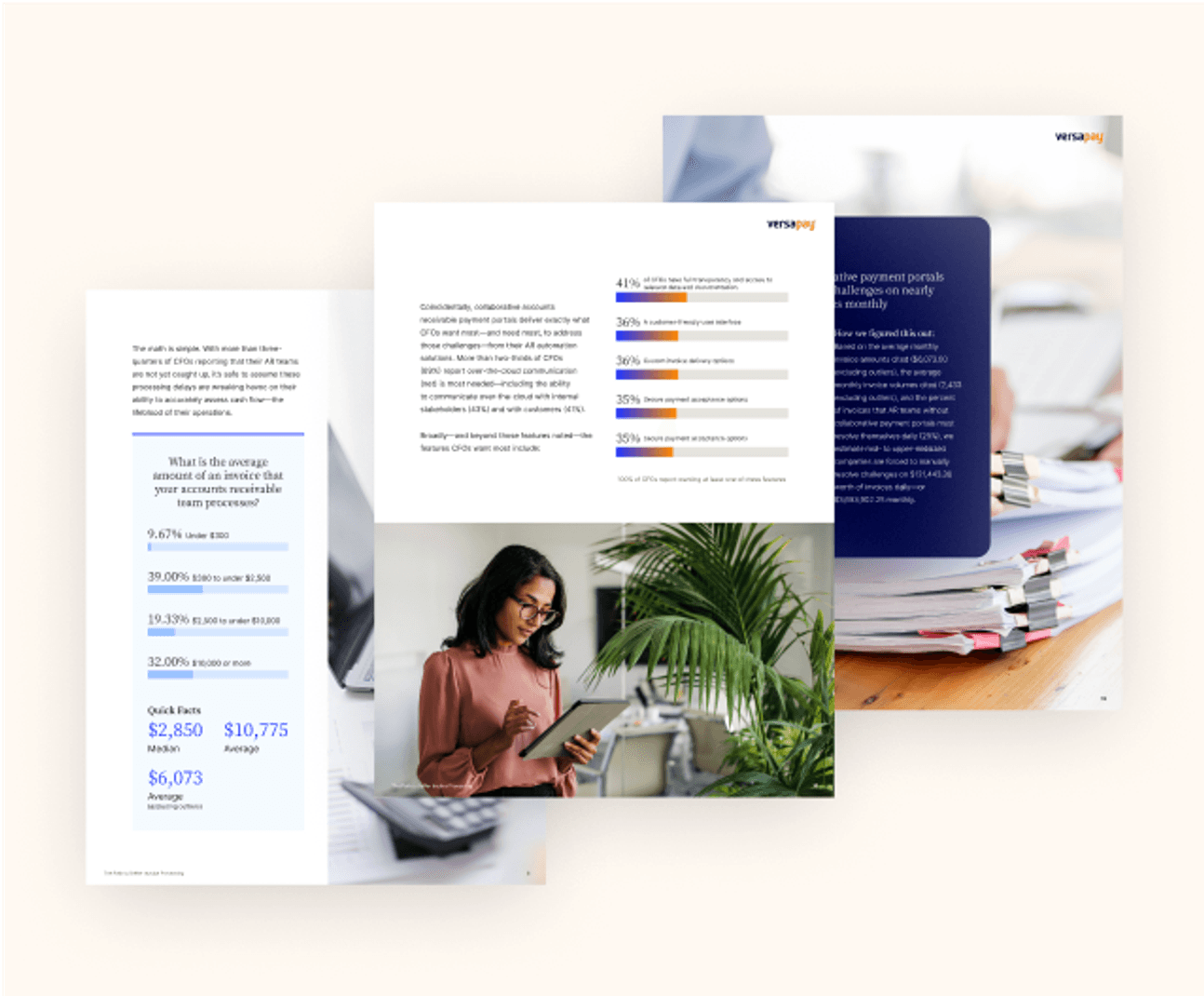

In collaboration with Wakefield Research, we surveyed 300 CFOs to learn about their most mission-critical function—invoice processing. It turns out invoice processing complications are so profound that 77% of accounts receivable teams are delayed.

Get the free report to see why collaborative accounts receivable payment portals are the best solution for fixing your invoicing woes.

Here's what you'll learn:

Invoicing shouldn't threaten your business

- The impact of inefficient invoicing processes

- Why collaborative payment portals are an essential technology in all CFOs' future toolkits

- Why collaborative payment portals outpace standard payment portals when it comes to CX

- How CFOs measure the ROI of collaborative payment portals

- How collaborative technology stabilizes cash flow by improving the invoicing process

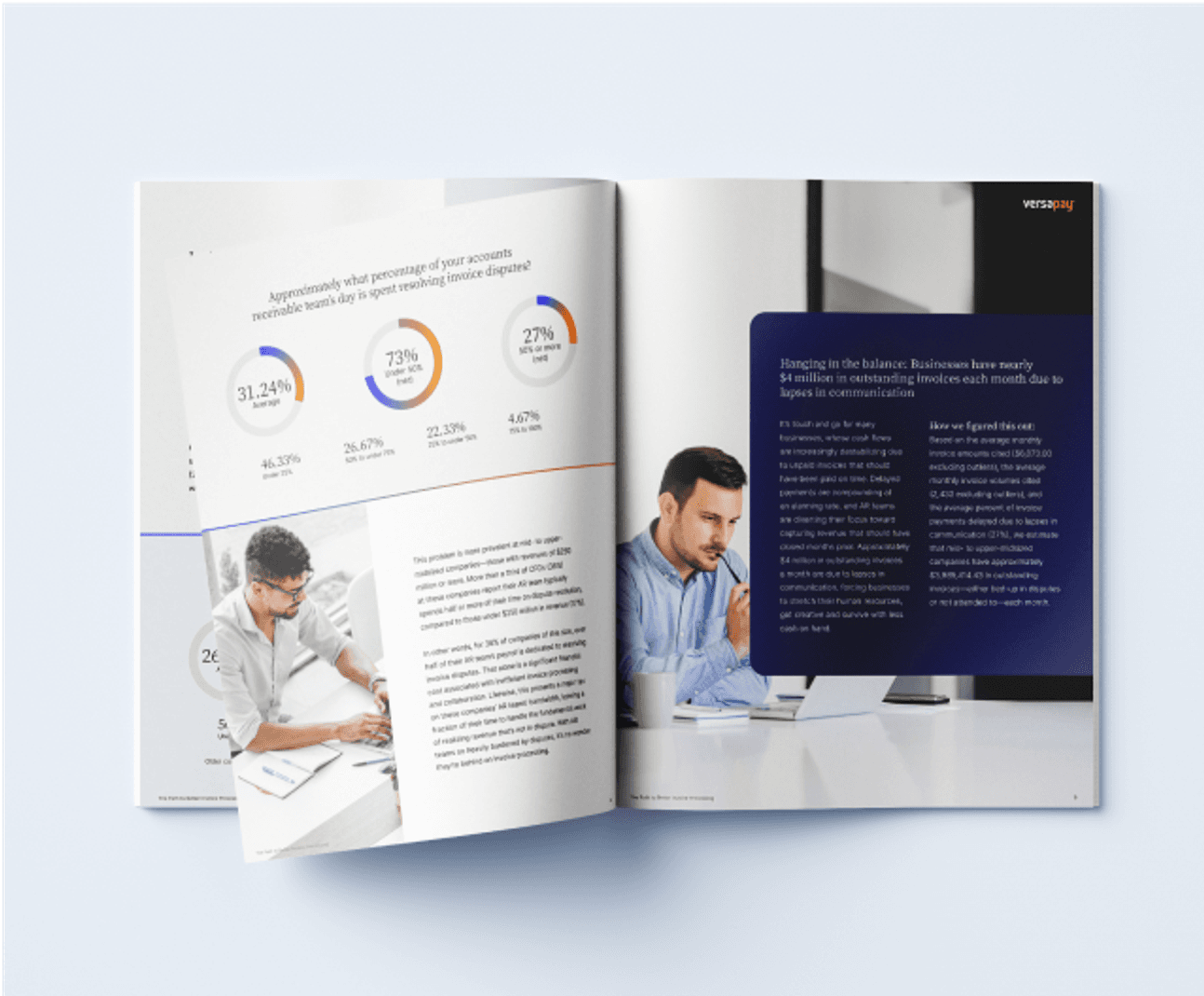

Peek at the impact poor invoicing processes have on accounts receivable teams

Seventy-seven percent

The percentage of accounts receivable teams that are not up to date

Four million dollars

Businesses have nearly $4 million in outstanding invoices each month due to lapses in communication

One-point six million dollars

Accounts receivable teams with collaborative payment portals are absolved from having to manually resolve over $1.6 million worth of invoices monthly

Get the 2023 State of Digitization in B2B Finance—The Path to Better Invoice Processing today!

Report abstract:

Collaborative technology accelerates cash flow

Invoicing delays pose a very real threat to a business' overall well-being; however, the contributing challenges are surmountable—if the right technologies are used. Collaborative payment portals are paramount for improving the invoicing process and they undeniably outpace standard payment portals with respect to bettering customer experience (CX).

CFOs without these portals report greater challenges with surfacing and making relevant data transparent, errors and data reconciliation, and internal communications. CFOs also see their customers enjoying the perks afforded by collaborative accounts receivable payment portals. Barely a third of CFOs (34%) believe their customers are more likely to value the simplicity of standard portals, instead emphasizing the outsized impact customer experience (CX) plays in their ROI evaluations.

In fact, for CFOs, a payment portal’s ability to influence CX is so consequential, traditional ROI measurements like direct labor efficiencies and time-savings are increasingly seen as lesser value indicators for these technologies.